- Gold prices have risen about 44 percent since September 2018, with many market watchers predicting the prices will continue to go higher

- Bullfrog Gold Corp. has been receiving assay results on a completed 25-hole drill project required for the company to buy a 100 percent interest in the site in September for potential gold recovery

- Five hole assays recently added to 15 already reported continue to show significant mineralization intercepts and define resource limits in established pits as well as a new target area

- The Bullfrog project area is located 125 miles northwest of Las Vegas in one of the most prolific gold exploration regions in North America

Precious metals exploration company Bullfrog Gold (CSE: BFG) (OTCQB: BFGC) (FSE: 11B) has released the results of additional assays on a recent hole-drilling program designed to identify gold and silver intercepts and strategically establish resource limits for its planning purposes.

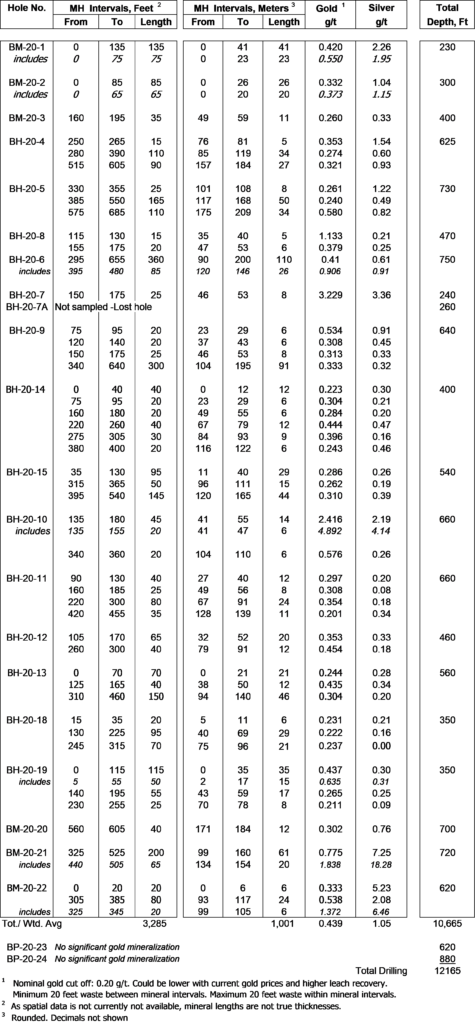

The company recently completed a 25-hole program on the 5,250-acre site within the Bullfrog Project outside of Beatty, Nev. The release of the program’s results adds five hole assays from the site’s Mystery Hill pit to the 15 previously announced from Mystery Hill, the Bullfrog and Montgomery-Shoshone (“MS”) pits and the new Paradise Ridge target during the past month, with five final assays and potential further analysis of the pits pending.

The closer spacing of the holes established by the newest assays support potential increases in resources in higher classifications, according to the company (http://ibn.fm/AhtzF). A column leach test of a new 0.34 g/t bulk sample achieved a 91 percent gold recovery from a very fine size compared to two prior samples from the Bullfrog pit that measured 1.2 g/t of gold with 83 percent recovery from the same fine size of material.

The new assays continue to show intercepts of thick intervals of gold mineralization in the Mystery Hill deposit, including 46 meters averaging 0.30 g/t and 24 meters of 0.35 g/t. The company noted another hole intersected 14 meters of gold mineralization at 2.42 g/t in the main Bullfrog vein, including 6 meters at 4.89 g/t starting at a depth of 42 meters.

Most of the thicker, lower grade intercepts are not in areas previously included in measured and indicated resource classifications. The NI 43-101-compliant resource estimates previously established within parts of the project area show 624,000 ounces of gold averaging 0.70 g/t in base case pit plans using a $1,200 gold price and 72 percent heap leach recovery. Other inferred resources were estimated at 129,000 ounces of gold at similar grades (http://ibn.fm/D9cCX).

“The north Bullfrog resources have been adequately drilled in all dimensions necessary to optimize and design a final pit plan, but a few more holes may be cored to provide samples for column leach testing. The MH now appears to have enough definition drilling, but core from one or two more holes may also be collected for column leach testing,” the company’s announcement states.

Beatty and the Bullfrog Project encompass one of the most prolific gold exploration regions in North America, 125 northwest of Las Vegas. Most of the drill project is on land developed by Barrick Bullfrog Inc. during the 1990s, producing about 2.3 million ounces of gold and 2.49 million ounces of silver using conventional milling operations before the project was shuttered when prices fell (http://ibn.fm/ApR7h).

Bullfrog Gold has access to a significant dataset developed by Barrick Bullfrog and is now working to fulfill a final work commitment that will allow the company to buy a 100 percent interest in the site in September for potential recovery using high pressure grinding rolls (“HPGR”) to produce column leach feeds having more minuscule micro-fractures.

Gold has enjoyed a sudden surge in demand during the COVID-19 pandemic, exemplified when prices settled above $1,800 per ounce in early July — about a 44 percent increase since its $1,202.44 low in September 2018, with some observers predicting it will reach $2,000 per ounce (http://ibn.fm/MgcDS).

The completion of the land purchase outside of Beatty would grant Bullfrog Gold control of the commanding land and mineral positions in the area.

The company has strong backing from strong players, and in January raised C$2 million to fund the current drilling program, perform environmental studies and conduct bulk sampling and metallurgical testing, adding new shareholders in the process.

Bullfrog Gold expects to raise more money later this year to buy a remaining piece of land from Barrick Bullfrog, hoping that the successful discoveries reported by the assays will allow the company to draw higher prices and move on to a preliminary environmental assessment and permitting.

For more information, visit the company’s website at www.BullFrogGold.com.

NOTE TO INVESTORS: The latest news and updates relating to BFGC are available in the company’s newsroom at http://ibn.fm/BFGC

About QualityStocks

QualityStocks is committed to connecting subscribers with companies that have huge potential to succeed in the short and long-term future. It is part of our mission statement to help the investment community discover emerging companies that offer excellent growth potential. We offer several ways for investors to learn more about investing in these companies as well as find and evaluate them.

QualityStocks (QS)

Scottsdale, Arizona

www.QualityStocks.com

480.374.1336 Office

Editor@QualityStocks.com

Scottsdale, Arizona

www.QualityStocks.com

480.374.1336 Office

Editor@QualityStocks.com

Please see full terms of use and disclaimers on the QualityStocks website applicable to all content provided by QS, wherever published or re-republished: http://www.qualitystocks.net/disclaimer.php

No comments:

Post a Comment